November 2025 Newsletter

Commentary

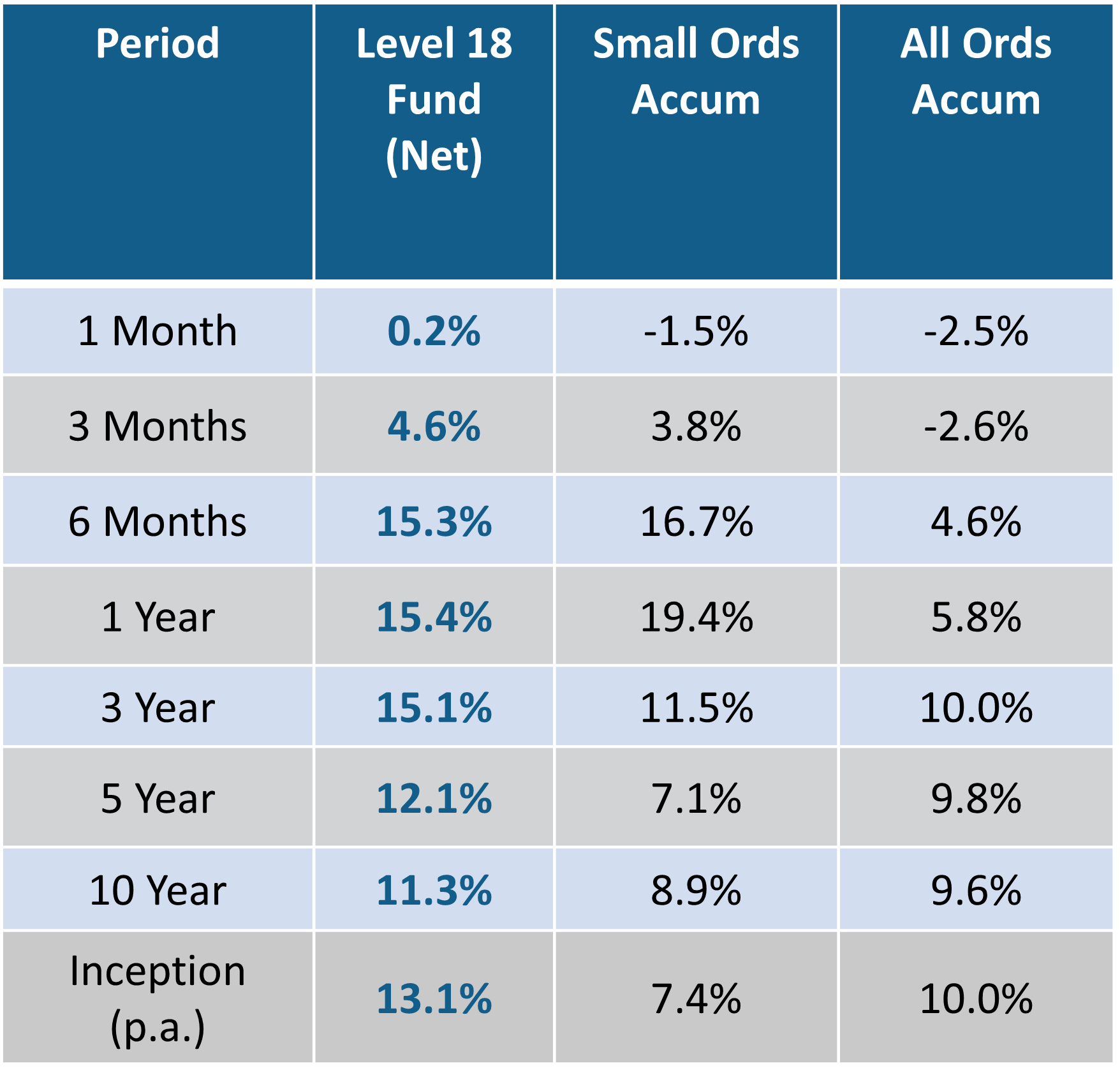

The Level 18 Fund increased by +0.2 per cent net of fees for the month.

November was a tough month for global equities as investors broadly took profits and equity valuations declined. In Australia, the S&P/ASX Small Ordinaries Accumulation Index and the All-Ordinaries Accumulation Index decreased by -1.5 per cent and -2.5 per cent respectively.

The Level 18 Fund outperformed during the month. Stock positioning protected the portfolio and avoided the market sell-off that occurred in November.

In the US the first five trading days delivered the worst start to a month since 2008. Selling pressure on AI-exposed stocks led the decline. Investors worried about valuations and the sustainability of forecast AI expenditure. Investors were also nervous that further interest rate cuts were going to be potentially delayed until 2026. At one point in November, Nasdaq was down nearly 8% from the October close. However, the final week of the month delivered a strong rally. The S&P 500 and the Nasdaq Composite Index finished the month up +0.1 per cent and down -1.5 per cent respectively.

A higher-than-expected inflation result for October created valuation pressure for the Australian market. In October, the adjusted headline CPI rose to 3.8 per cent year on year. While monthly data can be volatile, the RBA is likely to focus on the potential for upside risks in inflation. Another interest rate cut in December is now unlikely with some commentators suggesting the next move in rates may be up in 2026.

The local economy has started to see some benefits of the interest rate cuts that have been delivered to date. House prices, clearance rates and loan growth rates have all increased this year. In addition, Black Friday-Cyber Monday retail sales are forecast to deliver solid growth this year. The RBA’s commentary post the meeting in December will be important to gauge any change regarding the outlook for interest rates.

In a positive for US equities, weak employment data has increased the likelihood the Federal Reserve will cut interest rates by 25bps at its December meeting.

During the month, many of the portfolio’s exposures delivered AGM updates and YTD trading commentary. This year most of the outlook commentary has been positive. During the month additional contract wins were confirmed for SRG Global (SRG) and SKS Technologies (SKS). Monadelphous (MND) delivered an earnings upgrade and Symal (SYL), NRW Holdings (NWH), Cedar Woods Properties (CWP) and Wagners (WGN) provided investors with strong FY26 earnings guidance.

Markets never go up in a straight line and post the strong rally that started in mid-2025 we suspect the market decline in November represents a short-term consolidation. Small cap valuations remain attractive and continue to trade at a discount to large caps. The 12 month forward small cap PER multiple is currently 15.0x versus large caps at 18.5x. Our bullish 12-to-18-month outlook is unchanged.

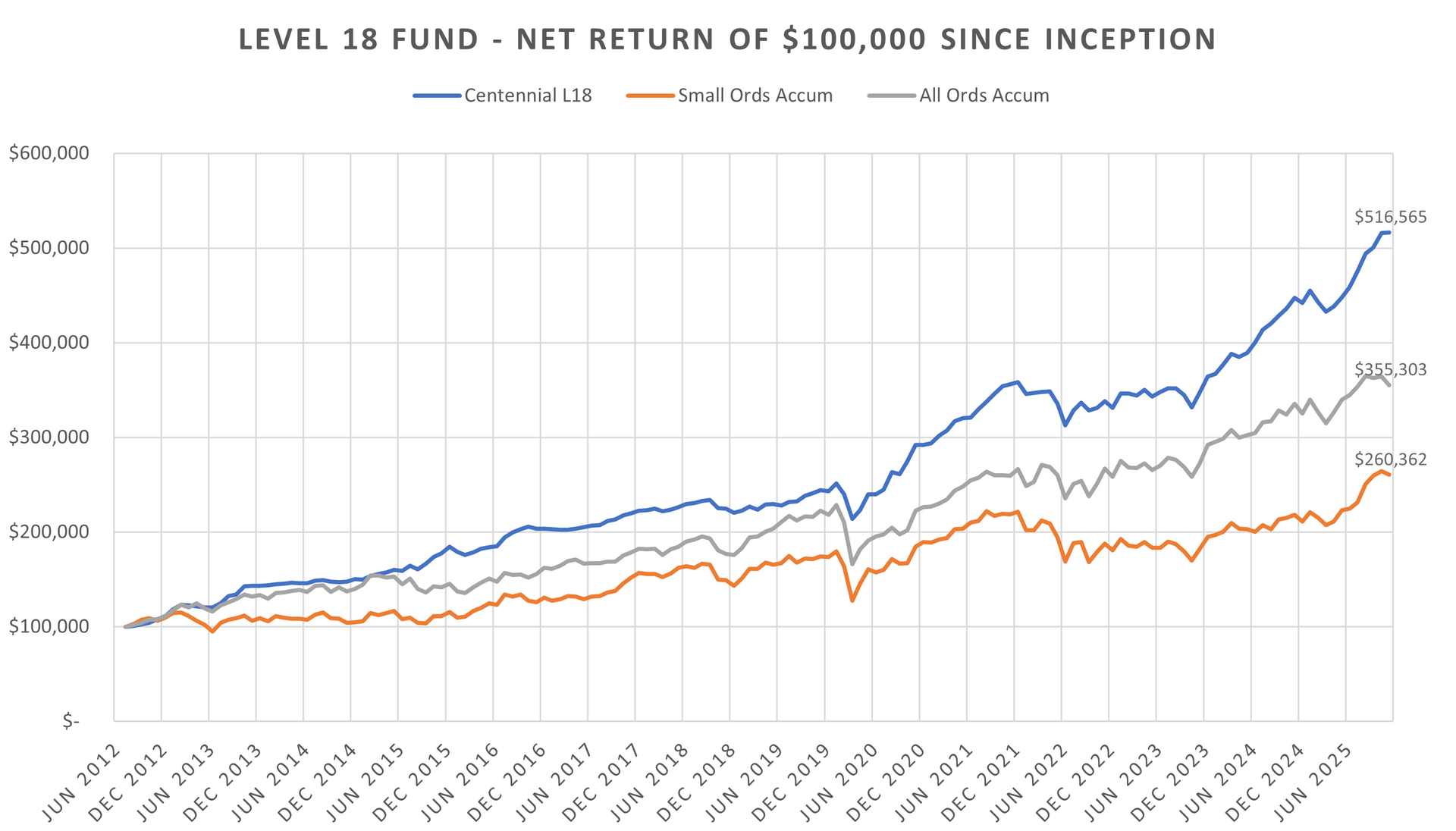

Since inception (2012), the Fund has delivered a +13.1 per cent net return per annum versus the All-Ordinaries Accumulation Index at +10.0 per cent and the S&P/ASX Small Ordinaries Accumulation Index at +7.4 per cent. The Fund’s flexible mandate has been designed to protect capital in correcting markets and deliver performance in rising markets.

Positive contributors to the Fund’s performance in November include construction materials and building product producer Wagners Holding (WGN), mining services group Macmahon Holdings (MAH), engineering, maintenance & construction group Monadelphous (MND) and equipment hire and civil remediation services provider Symal (SYL).

International motor vehicle dealership group Eagers Automotive (APE), Online employment marketplace services provider Seek (SEK), equipment financing and broking business COG Financial Services (COG) made negative contributions to performance in the month.

The Level 18 Fund Information Memorandum (IM) and application form are available on the Centennial Asset Management website. Please note existing unit holders are only required to compete a one-page additional application form. The following link (https://www.centennialfunds.com.au/) provides access to the IM and application documents.

Thank you as always for your continued support and please contact Michael Carmody (mcarmody@centennialfunds.com.au or +61 2 8071-9215) if you would like any further details.

The Centennial Team

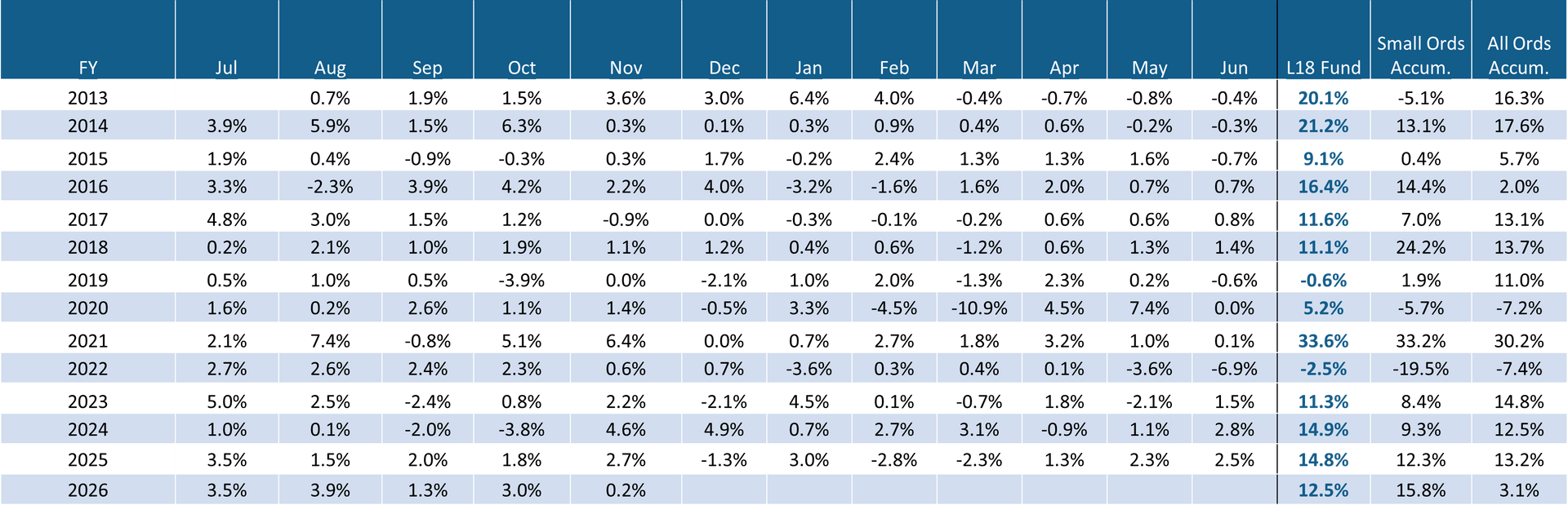

Monthly Net Returns Since Inception

About Centennial Asset Management

Centennial Asset Management is an independent Australian asset management business, and the manager of the Level 18 Fund, an index unaware fund, with asset allocation flexibility and a concentration of small capitalised companies. Further information on Centennial is available on our website - www.centennialfunds.com.au

Disclaimer

Strictly confidential: This report has been prepared by Centennial Asset Management ACN 605 827 745 & AFSL No. 515887 for Wholesale Clients only as an indicative record of the performance of an investment in the Level 18 Fund. No recommendation is made or advice given in respect of any entity in which the Level 18 Fund has, is or may in the future be, invested. The contents of this report are confidential, and the client may only disclose such contents to its officers, employees or advisers on a need to know basis, or with the prior written consent of Centennial Asset Management. Centennial Asset Management does not guarantee the performance of the Level 18 Fund or the return of any investor's capital in the Level 18 Fund. This investment report contains historical information, and does not imply any indication of future performance, recommendation or advice. Past performance is not a reliable indicator of future performance. Any investment needs to be made in accordance with and after reading any relevant offer document. This material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Centennial Asset Management accepts no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, none of Centennial Asset Management, or any related body corporate or any officer or employee of any of them makes any warranty as to the accuracy or completeness of the information in this report and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable or incomplete. *Prior to launch of the Level 18 Fund on 1 September 2014, Centennial Asset Management had established a separately managed account (“SMA”) and performance prior to 1 September 2014 is illustrated on a gross pro-forma basis, that invests with the same mandate as the Level 18 Fund and is included in the tables above, for comparative purposes only. The returns assume reinvestment of distributions.