October 2025 Newsletter

Commentary

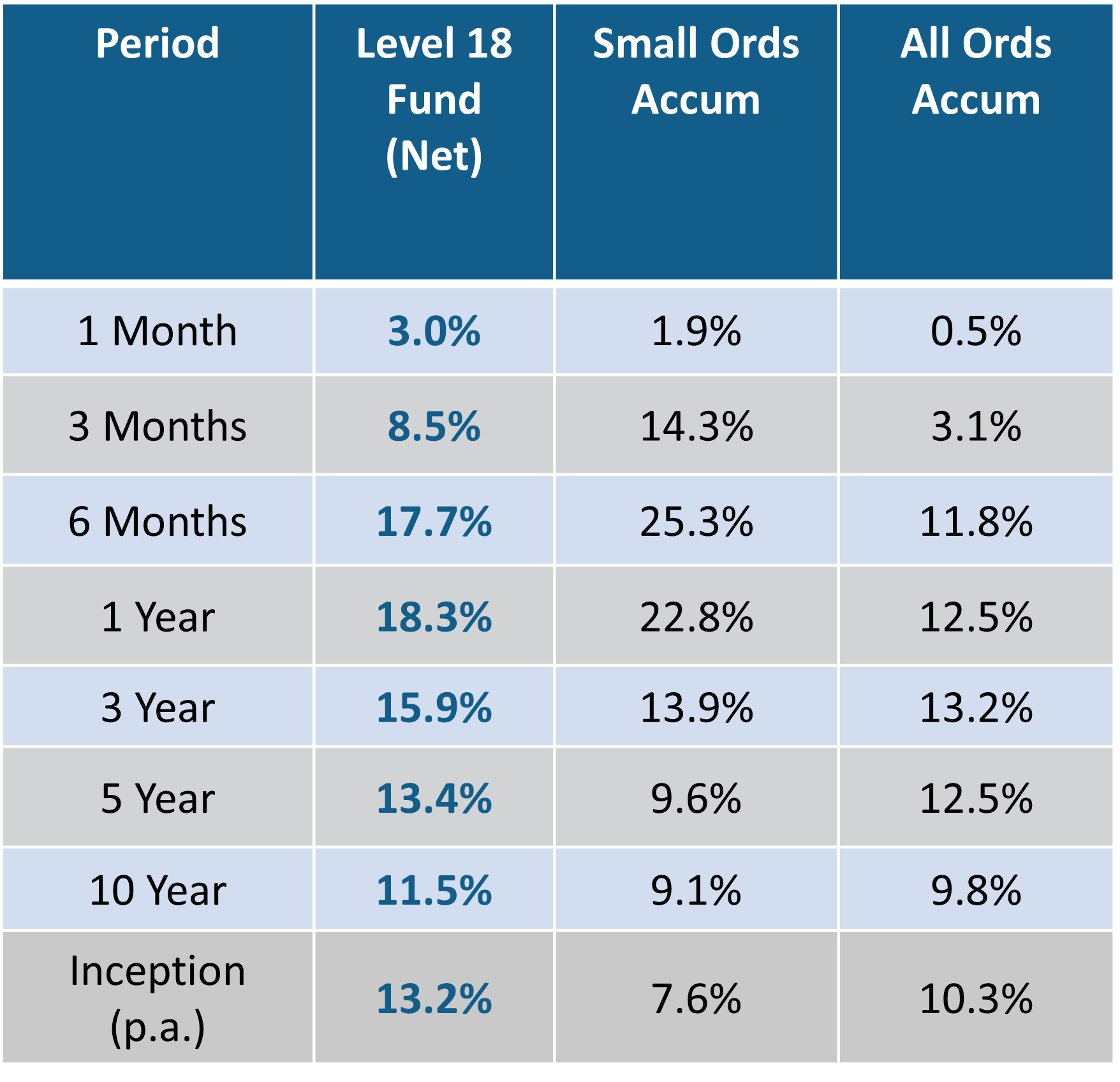

The Level 18 Fund increased by +3.0 per cent net of fees for the month.

During October the S&P/ASX Small Ordinaries Accumulation Index and the All Ordinaries Accumulation Index increased by +1.9 per cent and +0.5 per cent respectively.

The Level 18 Fund outperformed during the month primarily due to the portfolio’s exposure to the Housing, Defence and Financial services sectors.

Following a higher-than-expected underlying inflation result in the September quarter, the Reserve Bank of Australia (RBA) elected to hold official interest rates steady at 3.6 per cent at its November meeting. Post the meeting, RBA Governor Michelle Bullock said that the central bank was still “confident” inflation was coming down. The RBA’s policy statement noted that “some of the increase in underlying inflation in the September quarter was due to temporary factors.”

The RBA has now cut interest rates three times, and the benefits have started to become evident in the broader economy. House prices, clearance rates and loan growth rates have all increased this year. We expect lower interest rates, moderating inflation and a proportionally higher exposure to domestic demand to benefit the Level 18 Fund’s exposure to small caps.

Australian small cap caps continued to outperform large caps during October.

US equities performed well in October as AI exposed companies reported strong earnings growth. Specifically, the S&P 500 and the Nasdaq Composite Index finished the month up +2.3 per cent and +4.7 per cent respectively.

During the month, the US Federal Reserve cut rates by 25bps. This is the second US cut this year. Post the decision, FED Chair Jerome Powell suggested another cut in December was not a certainty.

Portfolio holding Eagers Automotive (APE) performed well in October. The company expanded its business internationally into the Canadian market via an investment in CanadaOne. APE has taken a majority position (65%) in CanadaOne for A$1.043B with the founder retaining the remaining 35%. Associated with the transaction was an entitlement offer at $21 a share that raised $452M.

The transaction provides APE with access to a significantly larger market and the potential for further growth. The CanadaOne acquisition significantly increases APE’s scale and global footprint. The deal is expected to be immediately earnings accretive. The APE share price has performed well post the deal announcement. The stock is currently trading at $31.83 a share.

Equity markets have delivered a strong start to FY26. While valuations are not cheap, history tells us that some of the best periods for the stock market returns come towards the end of bull markets. We remain bullish on the outlook for equities in the next 12-24 months.

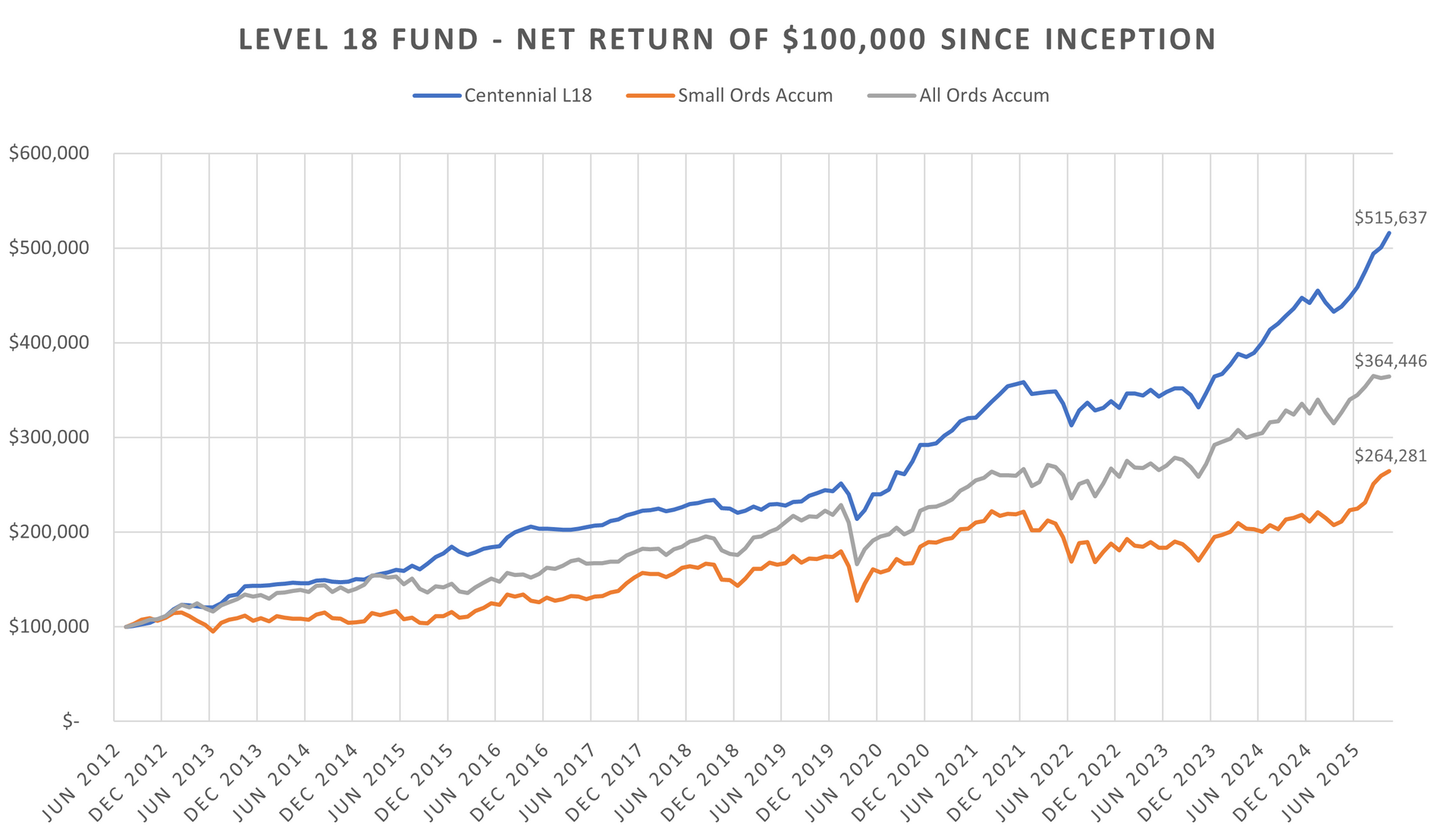

The Centennial Level 18 Fund recently reached its 13th year milestone. The Fund’s flexible mandate protects capital in bad markets and delivers performance in rising markets. Since inception (2012), the Fund has delivered a +13.2 per cent net return per annum versus the All-Ordinaries Accumulation Index at +10.3 per cent and the S&P/ASX Small Ordinaries Accumulation Index at +7.6 per cent.

Positive contributors to the Fund’s performance in October include specialty asset maintenance engineering group SRG Global (SRG), construction contracting, equipment hire and civil remediation services provider Symal (SYL), motor vehicle retailing & services group Autosports Group (ASG) and electrical and telecommunications infrastructure product & services group Mayfield Group (MYG).

Online employment marketplace services provider Seek (SEK), diagnostic imaging services group Integral (IDX) and mortgage broking business Australian Finance Group (AFG) made negative contributions to performance in the month.

The following link (https://www.livewiremarkets.com/wires/matthew-kidman-the-two-best-times-to-make-money-in-markets-are-coming) to a recent interview with Matthew Kidman on the Livewire platform provides readers with additional detail regarding our ‘bullish’ outlook for Australian small cap equities.

The Level 18 Fund Information Memorandum (IM) and application form are available on the Centennial Asset Management website. Please note existing unit holders are only required to compete a one-page additional application form. The following link (https://www.centennialfunds.com.au/) provides access to the IM and application documents.

Thank you as always for your continued support and please contact Michael Carmody (mcarmody@centennialfunds.com.au or +61 2 8071-9215) if you would like any further details.

The Centennial Team

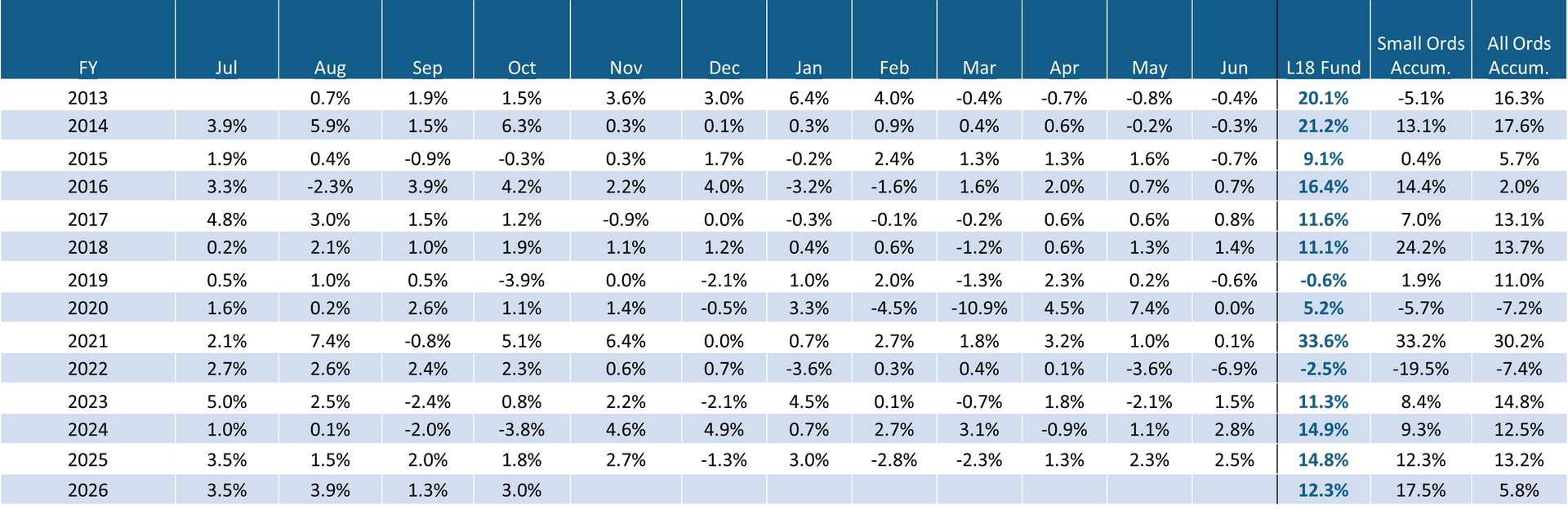

Monthly Net Returns Since Inception

About Centennial Asset Management

Centennial Asset Management is an independent Australian asset management business, and the manager of the Level 18 Fund, an index unaware fund, with asset allocation flexibility and a concentration of small capitalised companies. Further information on Centennial is available on our website - www.centennialfunds.com.au

Disclaimer

Strictly confidential: This report has been prepared by Centennial Asset Management ACN 605 827 745 & AFSL No. 515887 for Wholesale Clients only as an indicative record of the performance of an investment in the Level 18 Fund. No recommendation is made or advice given in respect of any entity in which the Level 18 Fund has, is or may in the future be, invested. The contents of this report are confidential, and the client may only disclose such contents to its officers, employees or advisers on a need to know basis, or with the prior written consent of Centennial Asset Management. Centennial Asset Management does not guarantee the performance of the Level 18 Fund or the return of any investor's capital in the Level 18 Fund. This investment report contains historical information, and does not imply any indication of future performance, recommendation or advice. Past performance is not a reliable indicator of future performance. Any investment needs to be made in accordance with and after reading any relevant offer document. This material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Centennial Asset Management accepts no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, none of Centennial Asset Management, or any related body corporate or any officer or employee of any of them makes any warranty as to the accuracy or completeness of the information in this report and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable or incomplete. *Prior to launch of the Level 18 Fund on 1 September 2014, Centennial Asset Management had established a separately managed account (“SMA”) and performance prior to 1 September 2014 is illustrated on a gross pro-forma basis, that invests with the same mandate as the Level 18 Fund and is included in the tables above, for comparative purposes only. The returns assume reinvestment of distributions.