January 2026 Newsletter

Commentary

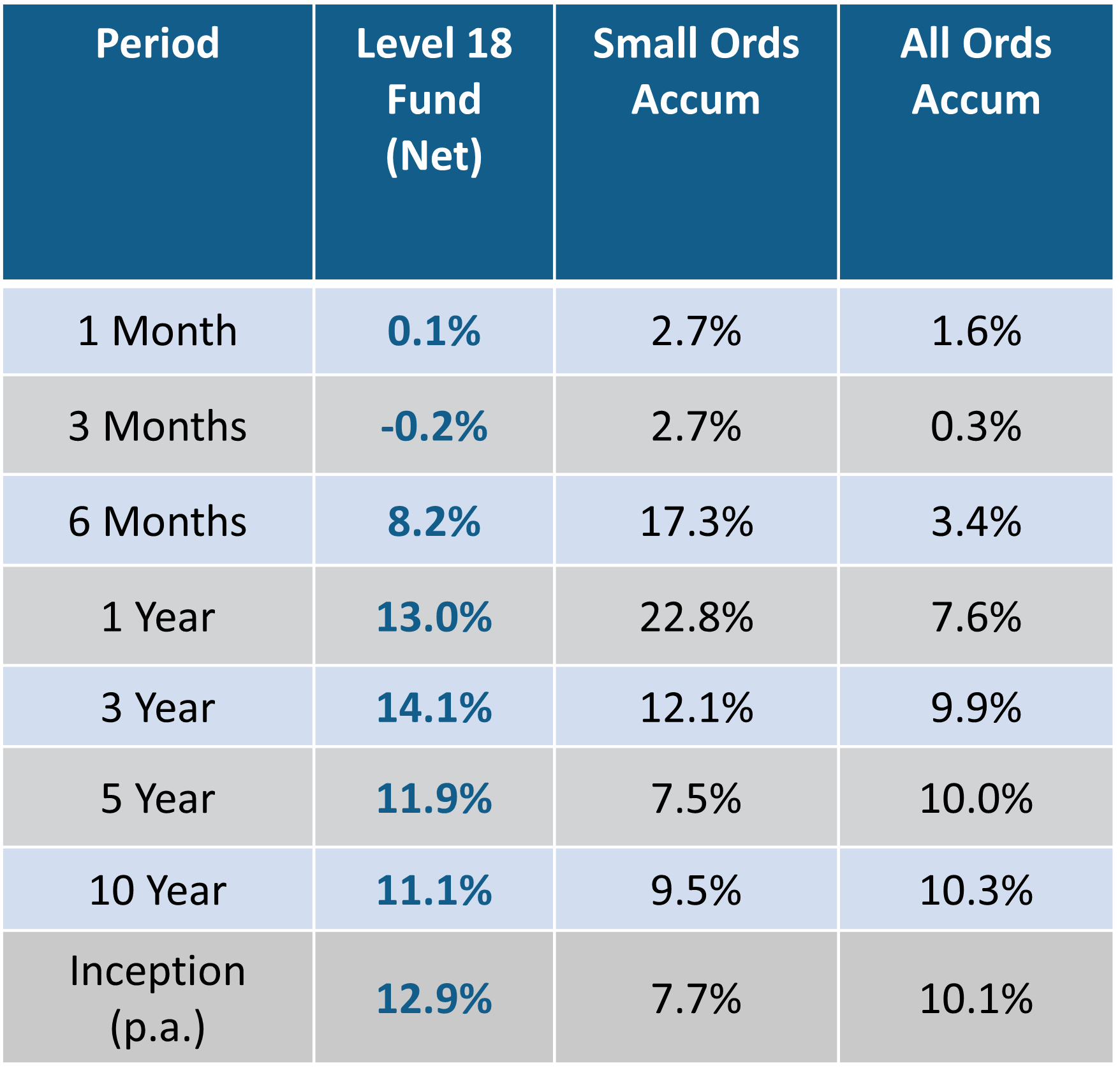

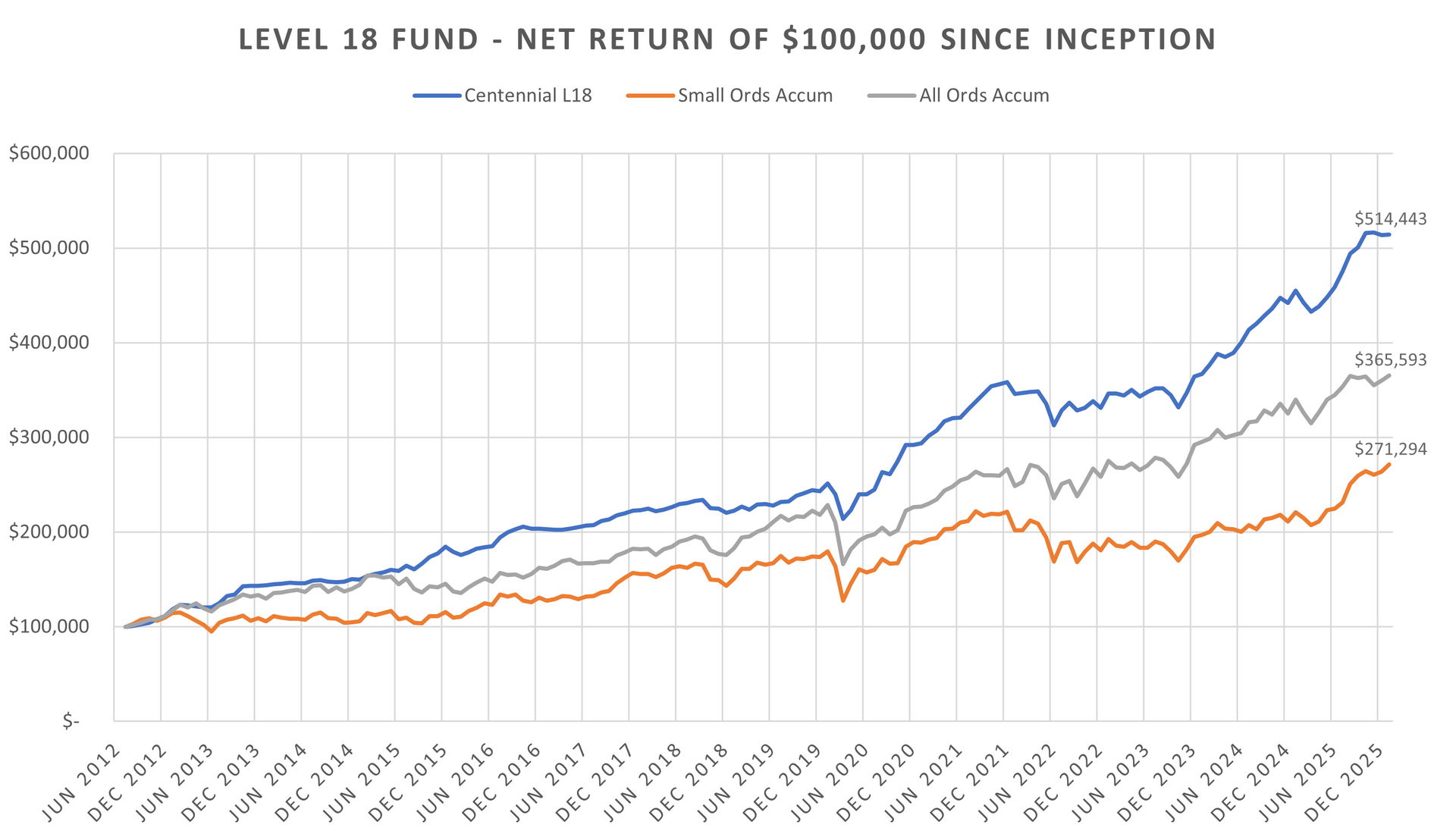

The Level 18 Fund increased by +0.1 per cent net of fees for the month. For the 12 months to January 31, 2025, the Fund increased by +13.0 per cent.

January was a positive month for equities in Australia where the S&P/ASX Small Ordinaries Accumulation Index and the All-Ordinaries Accumulation Index increased by +2.7 per cent and +1.6 per cent in the month respectively.

The Materials sector led the way in January rising +10 per cent on the back of strong commodity prices. In contrast, the Technology and Real Estate sectors moved lower as investors priced interest rate and valuation risks. Excluding the Materials sector, the market declined by -1.0 per cent in the month.

The US market was also positive in January, reversing the small negative performance in December. Investors regained some confidence in the mega-cap tech sector as quarterly results broadly met or exceeded market expectations. The US quarterly reporting season has been positive with approximately 76 per cent of companies delivering results ahead of consensus expectations. Significant AI-driven capital expenditure continues to exceed expectations from the US Mega-cap stocks.

The S&P 500 and the Nasdaq Composite Index finished the month up +1.4 per cent and flat respectively for the period. The Russell 2000 (US small caps) continued to outperform in the month, up +5.3 per cent.

During the month, the US Federal Reserve decided to leave interest rates on hold. The US market is now pricing two 25bp rate cuts during 2026. The recent ‘soft’ labour market data continues to support the consensus view that interest rates move lower through this year.

In Australia, core inflation slowed to 0.9 per cent from 1.0 per cent in the quarter. However, annual inflation increased to 3.4 per cent from 3.3 per cent in the previous quarter. Post the CPI result, the RBA elected to increase interest rates by 25 bps to 3.85 per cent. The RBA board, “judged that inflation is likely to remain above target for some time and it was appropriate to increase the cash target rate.”

Small cap resources performed well in January with the sector up +12.5 per cent for the month. In contrast, Small cap industrials were down -2.0 per cent. We expect the rally to increase exploration and production demand within the resources sector over the next 12 to 24 months. Several Level 18 Fund holdings within the engineering and maintenance services sector are likely to benefit from the increase in capital expenditure.

Monadelphous (MND) and NRW Holdings (NWH) both won additional contracts in January. Monadelphous announced it had been awarded a major long-term maintenance services contract with Rio Tinto valued at approximately $300M in aggregate over five years and NRW Holdings announced a mining services agreement with TEC Coal in Queensland’s Burnett Region.

We believe other portfolio holdings, ALS Limited (ALQ), SRG Global (SRG), Lycopodium (LYL) and Emeco Holdings (EHL) are also well positioned to benefit from the forecast lift in expenditure within the sector.

Reporting season has become increasingly volatile in the last decade, and we expect the 1H FY26 period to be no exception. Given the strong market performance over the last three years, investors are likely to have little tolerance for company earnings or outlook statements that miss market expectations. The reporting cycle is a good opportunity to review the operating environment for portfolio holdings and to identify new investment opportunities for the Fund. As is normal practice, we have built cash levels within the portfolio to take advantage of investment new ideas.

Positive contributors to the Fund’s performance in January include engineering, maintenance & construction group Monadelphous (MND), global metal recycling group Sims (SGM), construction and maintenance group GenusPlus (GNP) and engineering & project delivery services group Lycopodium (LYL).

Banking, superannuation & advice services group AMP (AMP), construction contracting, equipment hire and civil remediation services provider Symal (SYL) and gaming, wagering and entertainment group Tabcorp (TAH) made negative contributions to performance in the month.

The Level 18 Fund Information Memorandum (IM) and application form are available on the Centennial Asset Management website. Please note existing unit holders are only required to compete a one-page additional application form. The following link (https://www.centennialfunds.com.au/) provides access to the IM and application documents.

Thank you as always for your continued support and please contact Michael Carmody (mcarmody@centennialfunds.com.au or +61 2 8071-9215) if you would like any further details.

The Centennial Team

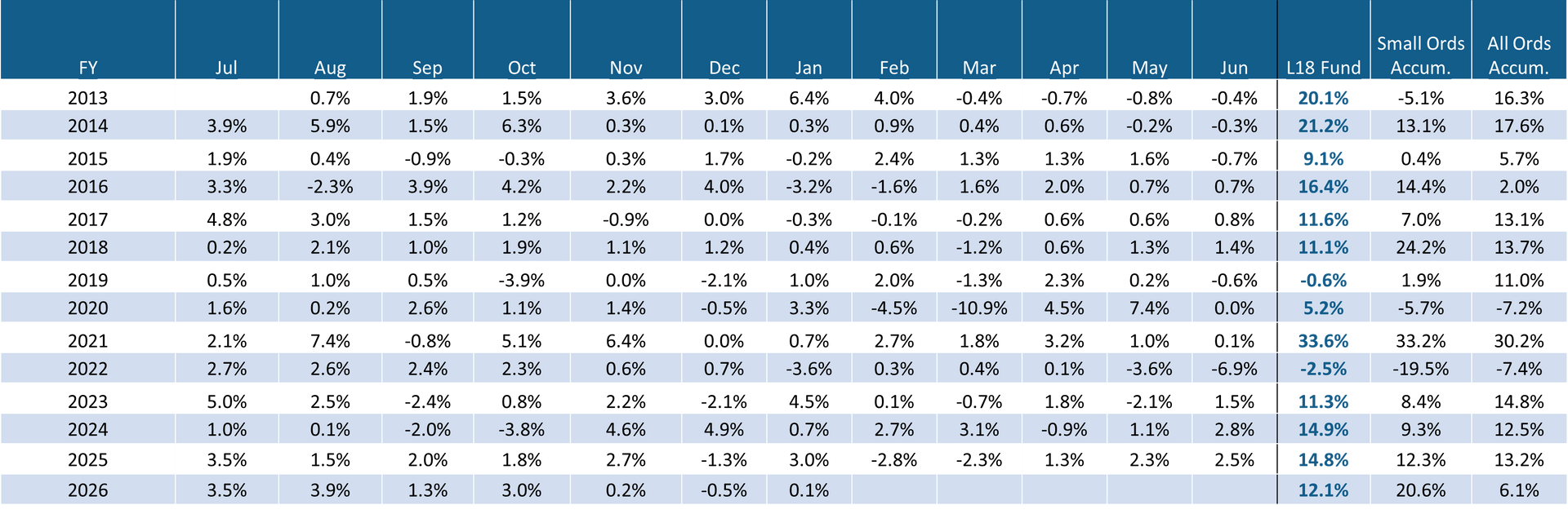

Monthly Net Returns Since Inception

About Centennial Asset Management

Centennial Asset Management is an independent Australian asset management business, and the manager of the Level 18 Fund, an index unaware fund, with asset allocation flexibility and a concentration of small capitalised companies. Further information on Centennial is available on our website - www.centennialfunds.com.au

Disclaimer

Strictly confidential: This report has been prepared by Centennial Asset Management ACN 605 827 745 & AFSL No. 515887 for Wholesale Clients only as an indicative record of the performance of an investment in the Level 18 Fund. No recommendation is made or advice given in respect of any entity in which the Level 18 Fund has, is or may in the future be, invested. The contents of this report are confidential, and the client may only disclose such contents to its officers, employees or advisers on a need to know basis, or with the prior written consent of Centennial Asset Management. Centennial Asset Management does not guarantee the performance of the Level 18 Fund or the return of any investor's capital in the Level 18 Fund. This investment report contains historical information, and does not imply any indication of future performance, recommendation or advice. Past performance is not a reliable indicator of future performance. Any investment needs to be made in accordance with and after reading any relevant offer document. This material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Centennial Asset Management accepts no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, none of Centennial Asset Management, or any related body corporate or any officer or employee of any of them makes any warranty as to the accuracy or completeness of the information in this report and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable or incomplete. *Prior to launch of the Level 18 Fund on 1 September 2014, Centennial Asset Management had established a separately managed account (“SMA”) and performance prior to 1 September 2014 is illustrated on a gross pro-forma basis, that invests with the same mandate as the Level 18 Fund and is included in the tables above, for comparative purposes only. The returns assume reinvestment of distributions.