August 2025 Newsletter

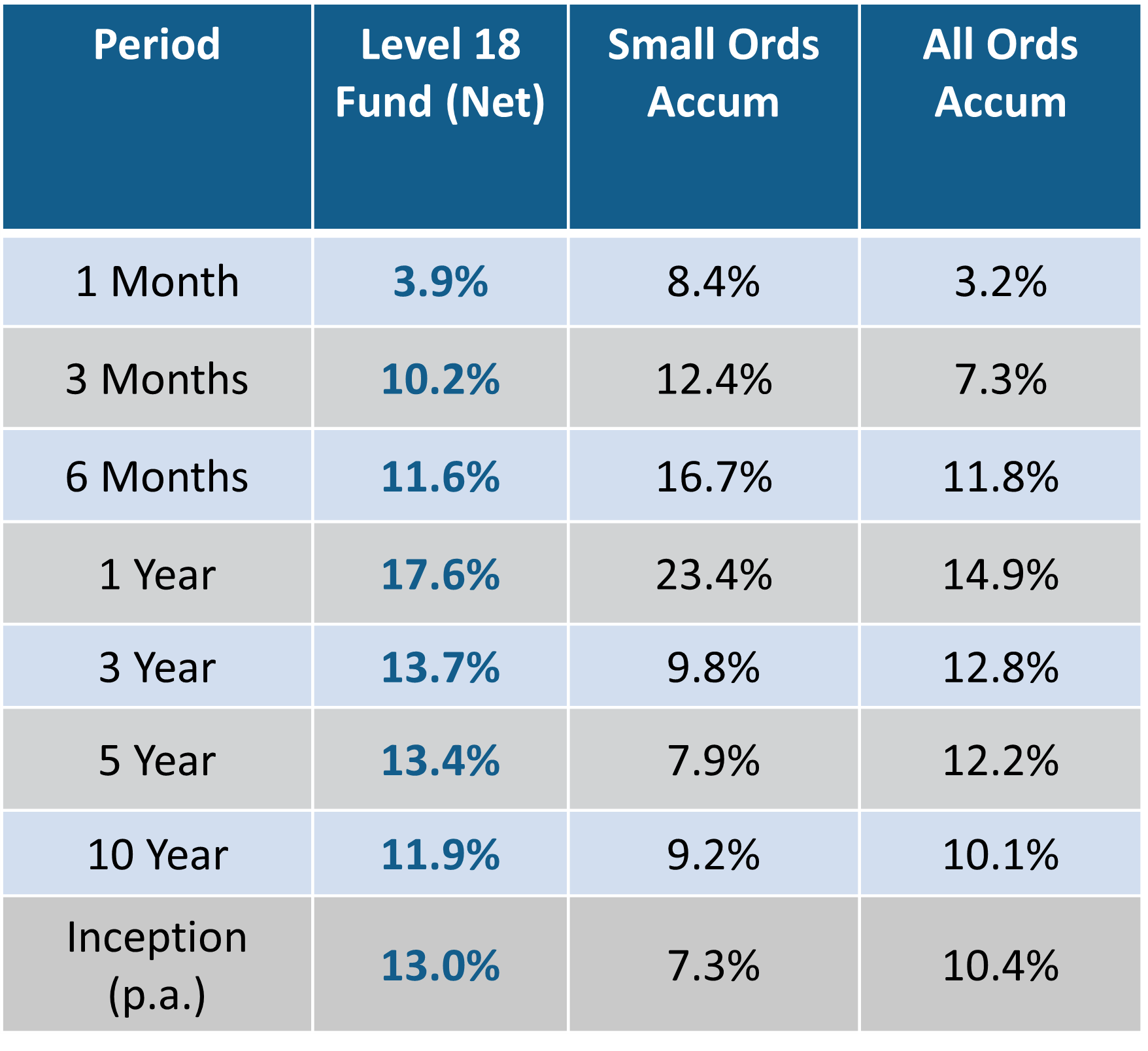

The Level 18 Fund increased by +3.9 per cent net of fees for the month.

Commentary

The Level 18 Fund increased by +3.9 per cent net of fees for the month.

During the month the S&P/ASX Small Ordinaries Accumulation Index and the All Ordinaries Accumulation Index increased by +8.4 per cent and +3.2 per cent respectively.

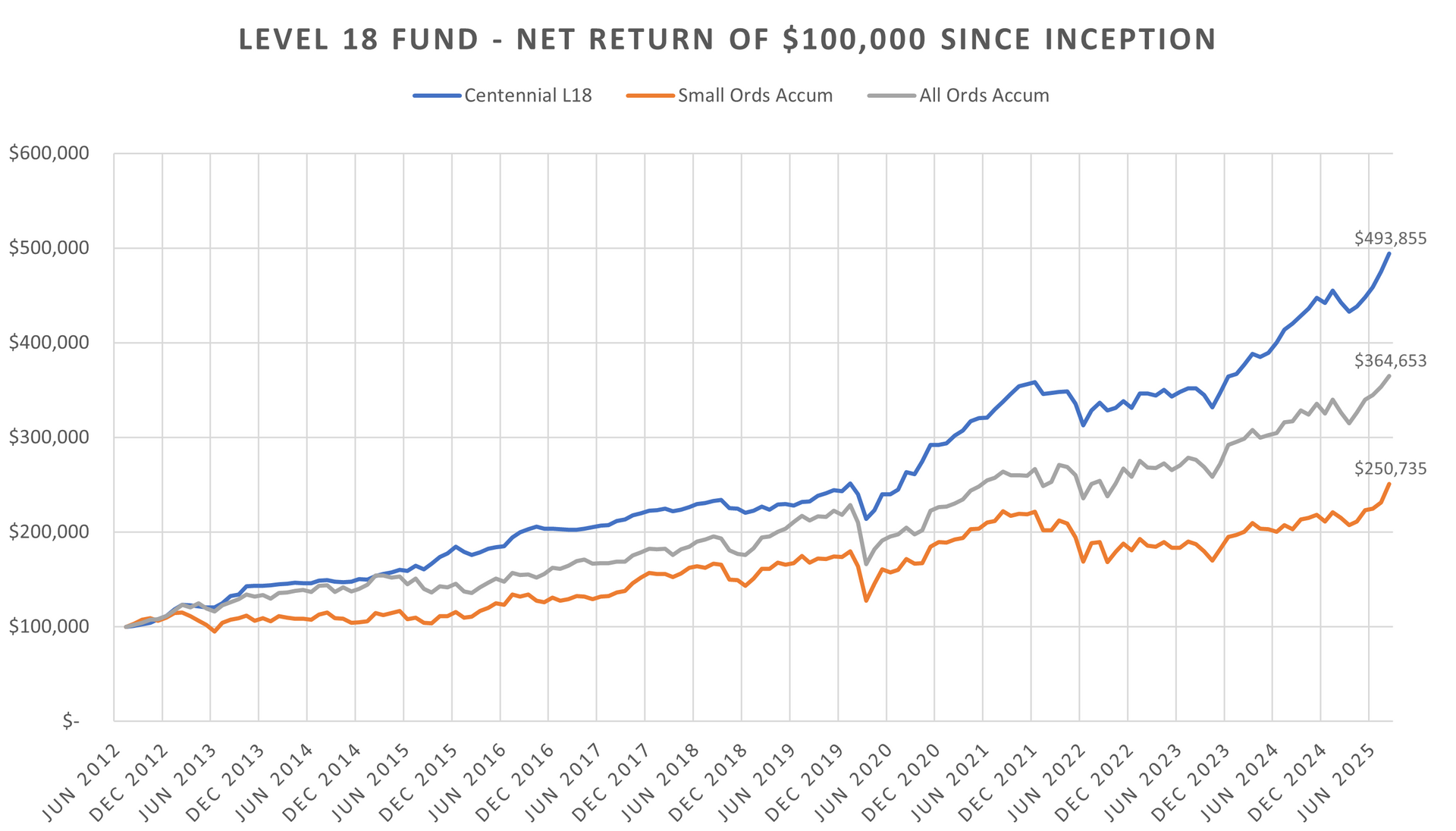

Since inception (2012), the Level 18 Fund has delivered a +13.0 per cent net return per annum versus the All Ordinaries Accumulation Index at +10.4 per cent.

The small cap resource sector was very strong during August delivering a return of +13.5 per cent in the month, outperforming small cap industrials at +6.1 per cent. Multi-year gold price highs and commodity exposures to lithium, copper & rare earths drove the resource sector’s performance.

A volatile FY25 reporting season delivered a mixed set of earnings results. Notwithstanding several high profile ‘misses’, companies broadly ‘beat’ market earnings expectations. Domestic companies outperformed their global peers, delivering consistent operating margins and cash flow. Specifically, small cap industrials provided upside earnings surprise while global cyclicals were impacted by tariff headwinds, FX and a weak US housing market.

Management outlook commentary was predictably cautious, but the reporting season delivered evidence that the domestic economy and consumer demand is set to grow over the next 12-24 months.

Despite the focus on the share price falls and earnings downgrades across several large cap companies (JHX, CSL & DMP), the market traded at all time highs. Investors continue to price expectations of further RBA interest rate cuts and an improving GDP outlook.

The US equity market underperformed the Australian market in August, the S&P 500 index was up +2.0 per cent despite softer than expected Macro data (non-farm payroll revisions) during the month. A broadly positive quarterly reporting season where approximately 75 per cent of the S&P 500 index beat consensus estimates contributed to the rally. Like Australia, small caps also outperformed large caps.

Importantly, late in the month at the Jackson Hole Federal Reserve meeting, the Fed chair Jerome Powell suggested that the balance of economic risks had shifted, potentially warranting an adjustment to the Fed’s monetary policy stance. The majority of US investors now expect a rate cut in September.

In Australia, the RBA (Reserve Bank of Australia) cut interest rates by 25bp to 3.6 percent. The decision was widely anticipated given the pause at the previous meeting and easing inflation in the June quarter (2.7 per cent vs 2.9 per cent in the March quarter). The RBA has now cut interest rates three times. The next RBA meeting is in late September. Economists currently forecast a low probability of a further cut at the next meeting. We continue to expect several additional cut rates over the next 12 to 24 months.

During the month, Tuas (TUA) announced the acquisition of competitor and digital communications network operator M1. TUA undertook a capital raising to partly fund the transaction. The transaction is expected to generate material synergies and increased scale across the business leading to significant operational efficiencies. Given the management team’s well-established track record for acquisition execution, the transaction was well received by the market. The fresh capital was raised at $5.24 a share. The stock is currently trading at $7.55 a share.

Positive contributors to the Fund in August include payments and finance provider Zip Co (ZIP), motor vehicle retailing & services group Autosports Group (ASG), global FMCG rice food brand Ricegrowers (SGLLV) and Singapore mobile telecommunications service provider Tuas (TUA).

Online software accounting and business solution group Xero (XRO), specialist alternative investment manager Regal Partners (RPL) and residential aged care home provider Regis Healthcare (REG) made negative contributions to the performance in the month.

The Level 18 Fund Information Memorandum (IM) and application form are available on the Centennial Asset Management website. Please note existing unit holders are only required to compete a one-page additional application form. The following link (https://www.centennialfunds.com.au/) provides access to the IM and application documents.

Thank you as always for your continued support and please contact Michael Carmody (mcarmody@centennialfunds.com.au or +61 2 8071-9215) if you would like any further details.

The Centennial Team

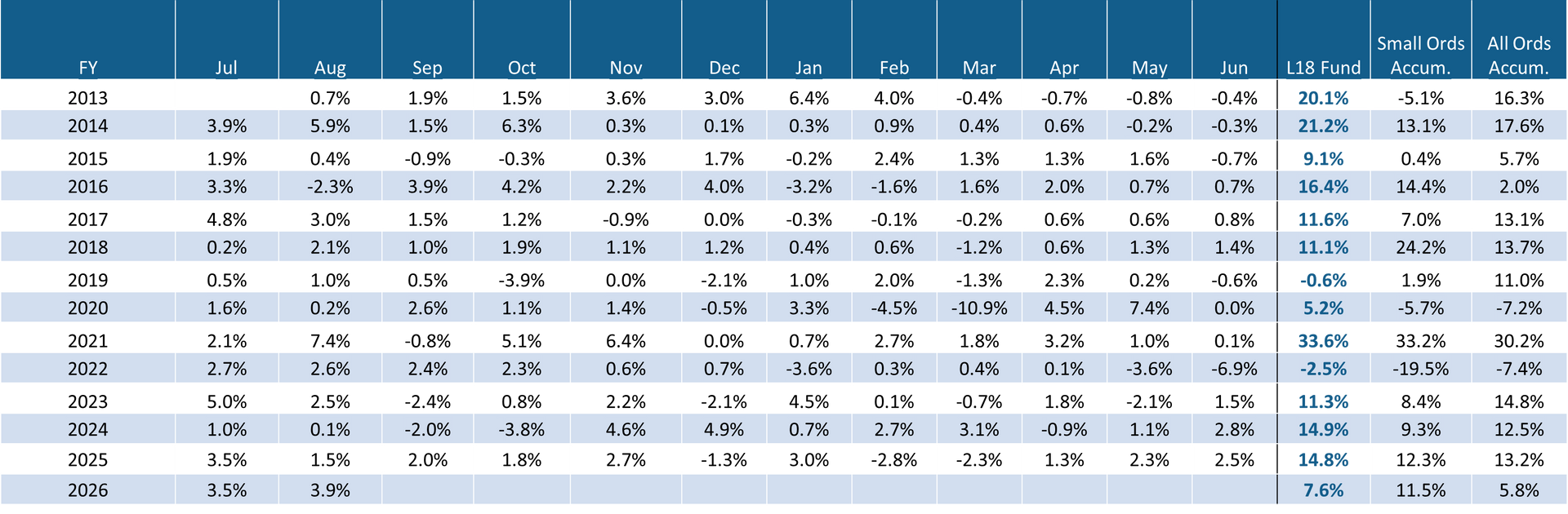

Monthly Net Returns Since Inception

About Centennial Asset Management

Centennial Asset Management is an independent Australian asset management business, and the manager of the Level 18 Fund, an index unaware fund, with asset allocation flexibility and a concentration of small capitalised companies. Further information on Centennial is available on our website - www.centennialfunds.com.au

Disclaimer

Strictly confidential: This report has been prepared by Centennial Asset Management ACN 605 827 745 & AFSL No. 515887 for Wholesale Clients only as an indicative record of the performance of an investment in the Level 18 Fund. No recommendation is made or advice given in respect of any entity in which the Level 18 Fund has, is or may in the future be, invested. The contents of this report are confidential, and the client may only disclose such contents to its officers, employees or advisers on a need to know basis, or with the prior written consent of Centennial Asset Management. Centennial Asset Management does not guarantee the performance of the Level 18 Fund or the return of any investor's capital in the Level 18 Fund. This investment report contains historical information, and does not imply any indication of future performance, recommendation or advice. Past performance is not a reliable indicator of future performance. Any investment needs to be made in accordance with and after reading any relevant offer document. This material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Centennial Asset Management accepts no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, none of Centennial Asset Management, or any related body corporate or any officer or employee of any of them makes any warranty as to the accuracy or completeness of the information in this report and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable or incomplete. *Prior to launch of the Level 18 Fund on 1 September 2014, Centennial Asset Management had established a separately managed account (“SMA”) and performance prior to 1 September 2014 is illustrated on a gross pro-forma basis, that invests with the same mandate as the Level 18 Fund and is included in the tables above, for comparative purposes only. The returns assume reinvestment of distributions.